cash tax refund check twice

This is an optional tax refund-related loan from MetaBank NA. In total she would be able to receive a tax refund of 7097.

I Pinimg Com Originals 55 35 B8 5535b846c999f91613

It is not your tax refund.

. Monday through Friday excluding holidays at 916874-6622. 1 2020 and before Dec. She would be able to receive a 1071 American opportunity credit 800 refundable and 271 nonrefundable a 3000 refundable child tax credit and a 3297 EIC.

3 Simple steps Fill Details Online Tax Agent Review and Get Refund In 1 Hour. Overseas Filipino workers OFWs infants 2 years and below and Filipino permanent residents abroad whose stay in the Philippines is less than one year. This is an optional tax refund-related loan from MetaBank NA.

In this case Mr C must check the Form 16 given by both the organisations. If you are not a Colorado resident andor pay taxes in another state you should check with that state or a tax advisor to determine the applicable state tax treatment. Passport when you go into the branch to cash a check as a non-customer.

It is not your tax refund. Approval and loan amount based on expected refund amount eligibility criteria and underwriting. Should input VAT exceed output VAT then a refund can be claimed from the Revenue Department.

Their online filing services have the ability to import your W2 information into your tax return so you can avoid worrying about your forms being delivered via snail mail. Charitable donations are tax-deductible for federal income tax purposes. A tax payer that has only zero-rated income will have the option to reclaim the input VAT.

Since provisional taxpayers earn money from other sources they have to complete an IRP6 return AND make manual payments to SARS. ActBlue cannot be responsible for your treatment of these donations on your tax returns. 31 2020 from eligible retirement plans.

You can check TIEZAs website for the full details on PH travel tax exemptions and reduced fees. These individuals are also exempted from the travel tax. It takes about three weeks for taxpayers that e-filed and chose to get the refund direct deposited whereas it can take more than six weeks for taxpayers.

Only applicable for the second provisional tax return. State tax deductions may also be subject. This is either in cash or as a credit against future output VAT.

An inflation rate that we calculate twice a year. All refund requests are subject to the availability of the contribution funds. Regular taxpayers make their tax contributions to SARS monthly via PAYE deducted off their paycheck automatically and submit one tax return every year for the end of February to describe their affairs - an ITR12.

A tax is a compulsory financial charge or some other type of levy imposed on a taxpayer an individual or legal entity by a governmental organization in order to fund government spending and various public expenditures regional local or national and tax compliance refers to policy actions and individual behaviour aimed at ensuring that taxpayers are paying the right amount. SELF ASSESSMENT TAX PAID TWICE TIME RS. Approval and loan amount based on expected refund amount eligibility criteria and underwriting.

In any one calendar year for one Social Security Number. I have not received my Income Tax refund for the year 2017 and 2018 till date despite. We can find your lost PAYG summaries Group Certificate for prior years also.

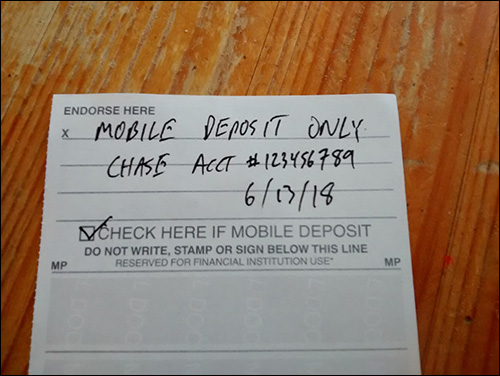

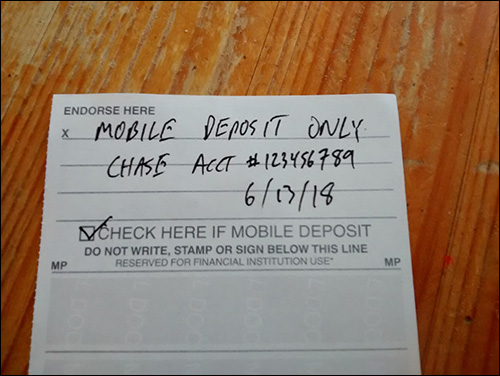

Those who file taxes electronically and receives their refund direct deposited to their bank accounts get it twice as faster as someone who mailed in the return and chose to get a refund check. 4722 Cash or Deferred Arrangements 47221 Program Scope and Objectives 472211 Background 472212nb Skip to main content. VAT paid input VAT is offset against the VAT charged on sales output VAT.

We break down everything you need to know when it comes to Spirit Airlines cancellation policy. PH Travel Tax Online Payment. When interest is earned and compounded.

Till I have not refund amount plz check my ITR stats plz refund my it refundable amount IAM retired person so we can understand my problem plz give replay on my email thanks. Need to cancel your Spirit Airlines flight. Nonqualified withdrawals are subject to federal and state income tax on the earnings portion and a 10 penalty on the earnings portion.

Withdraw tax refund from your Bank account or Collect Cash from our office. They even have a free tax refund calculator available that allows you to know the amount of money that you will be getting back in your tax refund. Highly qualified accounting team will check your Tax return Twice.

341890 341890 ON 27-SEPT-2018 BY. Loans are offered in amounts of 250 500 750 1250 or 3500. Allows tax-favored COVID-19 related distributions made on or after Jan.

Provisional tax paid for 1 st period - You will need to enter the amount that you have paid for the first provisional tax return. Her tax liability before any credits would be 271. Because ActBlue forwards contributions to the candidate cause or committee to whom you choose to.

Increases the allowable plan loan amount to 100000 from 50000 under. Maximum amount you can buy. In this case the TDS is a dead loss that can neither be recovered or adjusted in ITR.

You can efile income tax return on your income from salary house property capital gains business profession and income from other sources. To check on the status of a refund from current year tax overpayment due to reduction of current year assessed values you can contact the Tax Collection Division between 900 am. For additional information please refer to our Supplemental Addenda web page.

You may buy up to 10000 in electronic EE bonds up to 10000 in electronic I bonds and using your tax refund up to 5000 in paper I bonds. This is the highest tax refund among these scenarios. Further you can also file TDS returns generate Form-16 use our Tax Calculator software claim HRA check refund status and generate rent receipts for Income Tax Filing.

100 Australian Owned Company. If Organisation 1 has also included the joining bonus in Form 16 then Mr C will not be able to obtain a refund of the TDS from the income tax department. Every bank requires that you have two forms of government-issued ID ie drivers license and US.

Foreign tax credits for this period - if you earned money from overseas and any tax was withheld or paid include that amount here. Loans are offered in amounts of 250 500 750 1250 or 3500.

Www Cpapracticeadvisor Com Wp Content Uploads Site

Image Cnbcfm Com Api V1 Image 106834680 1612366771

Media Consumeraffairs Com Files Cache News Check W

I Pinimg Com 736x 1a Cd 61 1acd61b6a0be71394b3c9a2

S Yimg Com Ny Api Res 1 2 Nbkgepxs1d0jk2tjdfkbeq

![]()

I Pinimg Com Favicons E98eb43c22609da1682a8b908e50

Cdn Geekwire Com Wp Content Uploads 2015 06 Checks

Digitalasset Intuit Com Image A7mnknvha American R

Fox8 Com Wp Content Uploads Sites 12 2022 01 Getty

Parade Com Image T Share Mtkwntgxnduwnja1oti5ntk3

Www Hrblock Com Expat Tax Preparation Images Stimu

Www Digitalcheck Com Wp Content Uploads 2021 12 Re

I Pinimg Com Originals 41 6b 40 416b400a1af1b118d6

Www Cnet Com A Img Resize 93d0629eaafad0c3f44e7534

Img Money Com 2015 02 150219 Ff Taxrefundstolen Jp

Media Wtol Com Assets Wtol Images 52bc5e89 9155 4a

Www Cnet Com A Img Resize 99a2bf7983062978ca8a3b26